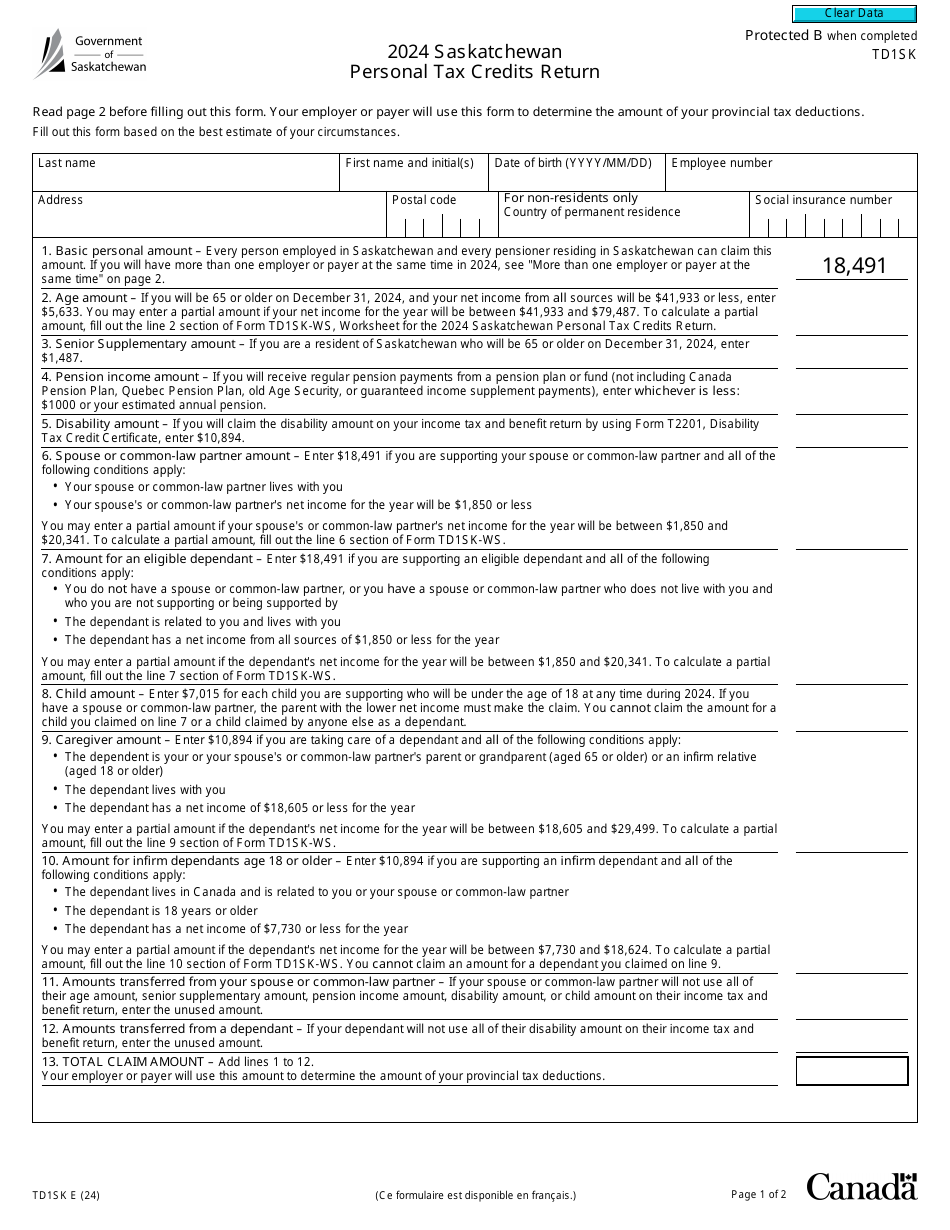

New Employee Tax Forms 2025 Saskatchewan - Nc State Tax Withholding Form For Employers, Td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay annually. Saskatchewan 2025 Tax Forms Amanda Thomasine, When you pay employment income such as salaries, wages or.

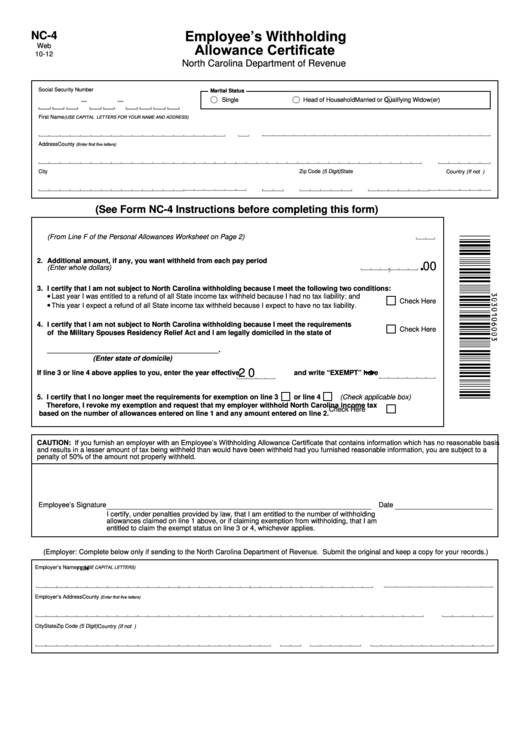

Nc State Tax Withholding Form For Employers, Td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay annually.

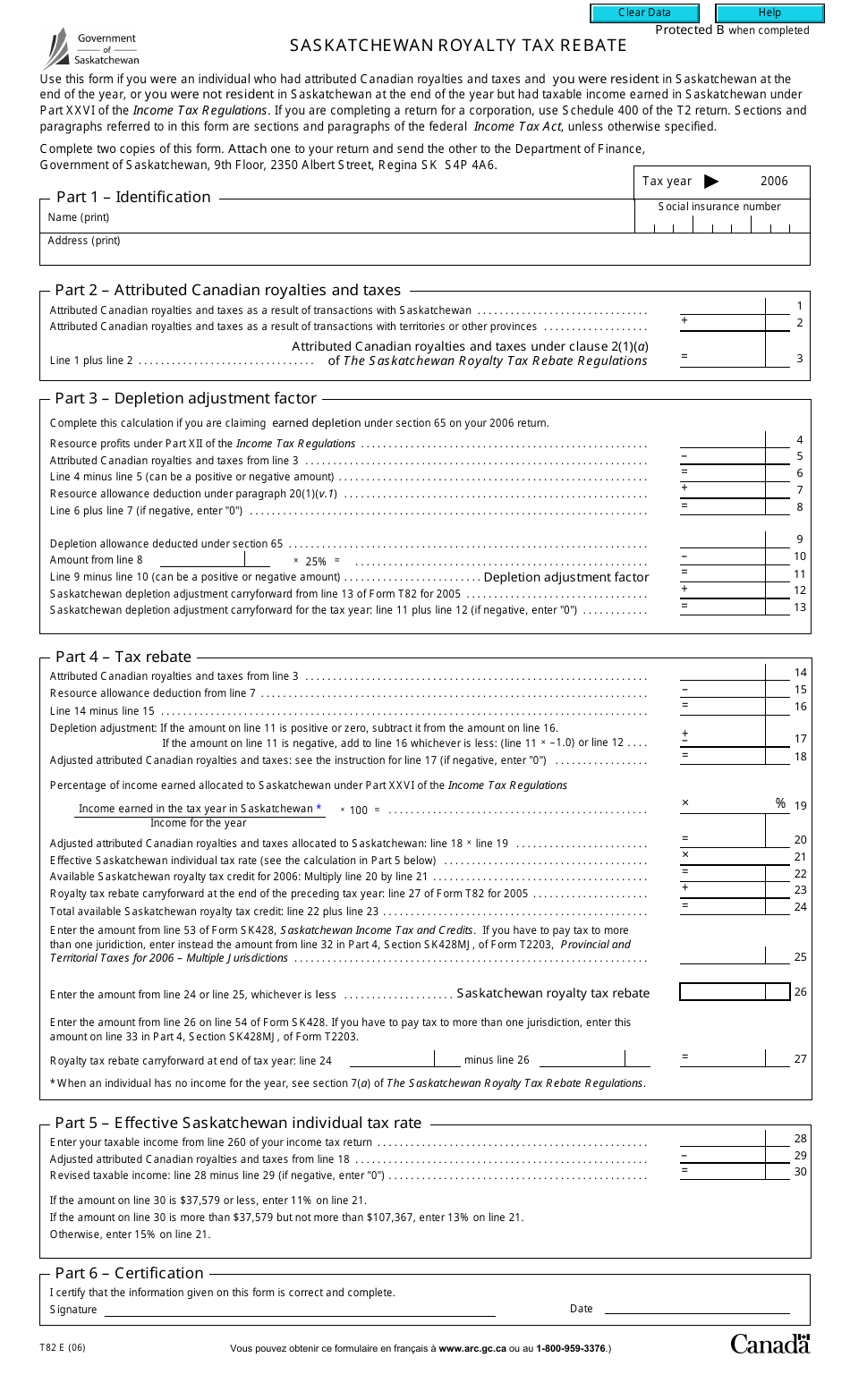

Saskatchewan 2025 Tax Forms Amanda Thomasine, We have built the tax credits and tax deductions for cpp contributions and ei premiums into the federal and provincial tax deductions tables in this guide.

Tax File Declaration Printable Form Printable Forms Free Online, This change is effective on january 1, 2025 and is identified with the tag new cra administrative policy.

New Employee Tax Forms 2025 Saskatchewan. Td1, personal tax credits return, is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension income. Estimate your 2023 tax refund or taxes owed, and check provincial tax rates in saskatchewan.

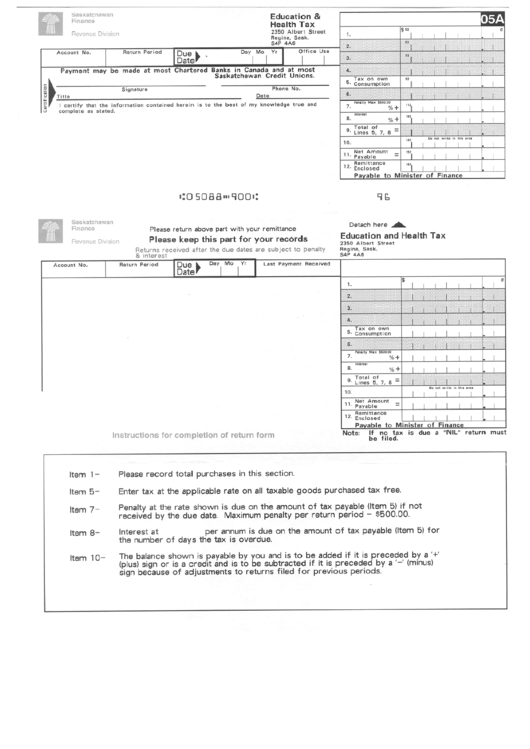

Form 05a Education And Health Tax Saskatchewan Department Of, Td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay annually.

New Employee Tax Forms 2025 Elsie Idaline, Td1, personal tax credits return, is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension income.

Saskatchewan Tax Forms 2025 Alanah Lettie, Td1s are required so your employer and the canada revenue agency can accurately estimate how much tax to take off your pay annually.

20252025 Form Canada T1213 Fill Online, Printable, Fillable, Blank, The tax tables below include the tax rates, thresholds and allowances.

How to deduct income tax, canada pension plan (cpp) contributions, and employment. The tax tables below include the tax rates, thresholds and allowances.

Employee New Hire Tax Forms at Suzanne Bartz blog, The tax tables below include the tax rates, thresholds and allowances.